Many business owners look for quick funds to grow their companies. Most of the time, the first thought is to take a loan. Loans may give you instant cash, but they come with interest, fixed payments, and added pressure. Before rushing to borrow money, it is smart to first look into grants for corporations. Grants can give your business the financial support it needs without the stress of repayment.

Loans Are Not Always the Best First Step

When you take a loan, the bank expects you to start paying it back almost immediately. This can be tough if your business is still trying to make a steady income. Missing a payment can hurt your credit score and make future borrowing harder. Loans also add stress because you are constantly worried about interest rates and deadlines.

Instead of jumping straight into debt, looking for business funding that does not need repayment is a better first step. This is where business grants come in. They can give you a financial push without the burden of paying back every month.

What Makes Business Grants Different

Business grants are like free money for your company. They are offered by government programs, private organizations, or foundations. Once you receive a grant, you can use it for purposes like expanding your office, buying equipment, hiring staff, or improving operations.

Unlike loans, grants do not need repayment. This means the money you get stays in your business. For small companies or startups, this can make a huge difference. Instead of using future profits to pay banks, you can focus on growing your business.

Types of Grants You Can Apply For

There are different kinds of grants available for business owners. Understanding these options can help you choose the ones that fit your needs.

- Government Grants – National, state, and local governments often offer funding programs to help businesses grow. They support businesses in areas like technology, green energy, healthcare, and community development.

- Private Organization Grants – Large companies and foundations sometimes give grants to support small businesses, startups, or businesses owned by women, minorities, or veterans.

- Research and Development Grants – If your company works on new products or innovative solutions, there are grants to help cover research costs.

- Community Grants – These are meant for businesses that bring positive change to local communities, like creating jobs or improving local services.

Knowing the right type of grant to apply for will save you time and increase your chances of success.

Why Grants Are a Smart Choice Before a Loan

Applying for a grant first gives you a chance to grow your business without taking on debt. Here’s why this approach makes sense:

- No repayment stress: You do not have to set aside money every month for a bank.

- Better cash flow: Money stays in your company to cover expenses or reinvest in growth.

- Improved credit position: You avoid loans until your business is stronger and better prepared for repayment.

- Potential for multiple grants: Some businesses receive more than one grant over time, giving them long-term support.

Even if you do not get a grant on your first try, the process can teach you how to present your business better, which is helpful for future applications or investors.

Tips to Increase Your Chances of Getting a Grant

Many business owners skip applying for grants because they think the process is complicated. While it does take effort, following these simple steps can help:

- Research carefully: Look for grants that match your industry, location, and business goals. Do not waste time on grants you do not qualify for.

- Prepare a clear business plan: Most grant providers want to know how their money will help your business grow. Write simple and clear points about your goals.

- Check deadlines: Many grants have strict application dates. Submitting late can automatically disqualify you.

- Gather required documents: Keep your business registration, tax records, and financial statements ready.

- Apply to multiple grants: This increases your chances. One rejection does not mean your business will never get a grant.

The Long-Term Benefits of Choosing Grants First

Starting with grants instead of loans can set your business up for long-term success. With free funding, you can focus on improving products, reaching more customers, and building a stable income. Once your business is stronger, you can consider loans for larger expansions with less risk.

Many successful businesses today started with grants. By reducing early financial pressure, owners were able to make smarter decisions and grow without constant stress.

Grow Your Business Without Adding Debt

Applying for grants for corporations before taking a loan can save your business from unnecessary debt and financial pressure. Grants give you the freedom to grow without the constant worry of repayment. Exploring the right opportunities can put your business on a stronger path.

Where to Find Reliable Grant Opportunities

Finding the right grant can take time, but using trusted sources makes the process easier. Government websites often list available programs. Business development centers and local chambers of commerce can also guide you.

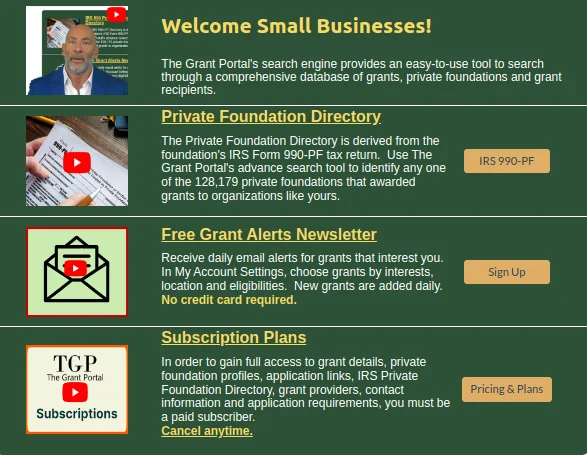

Platforms like The Grant Portal are useful for finding updated listings and application details in one spot.